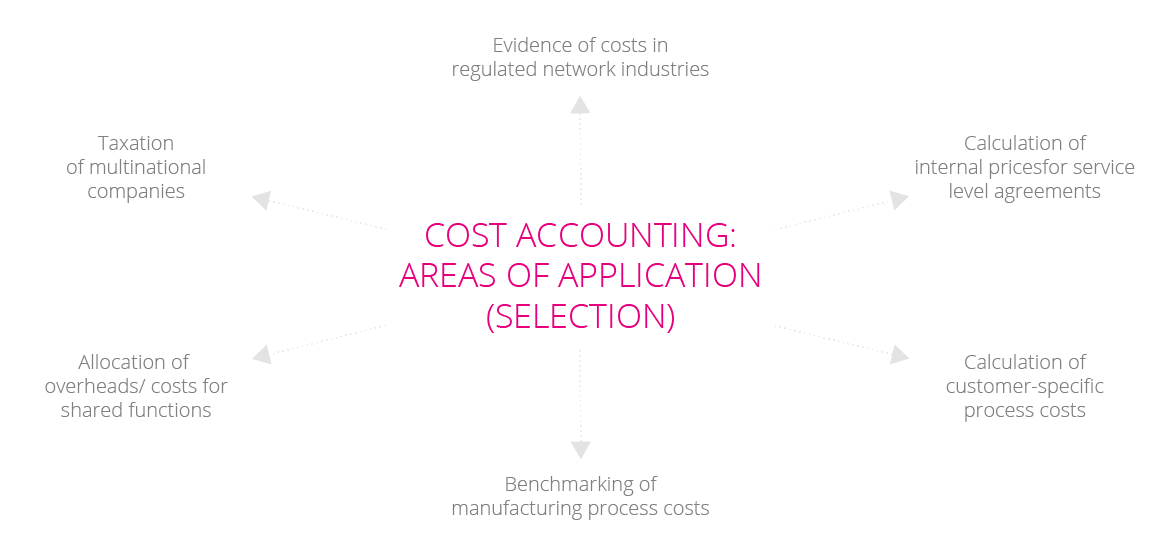

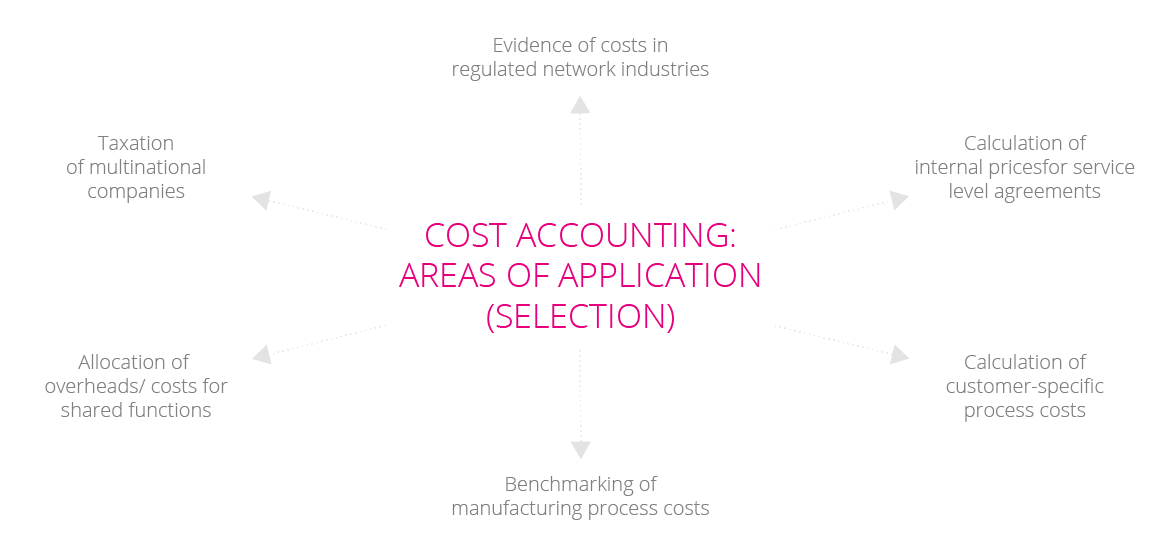

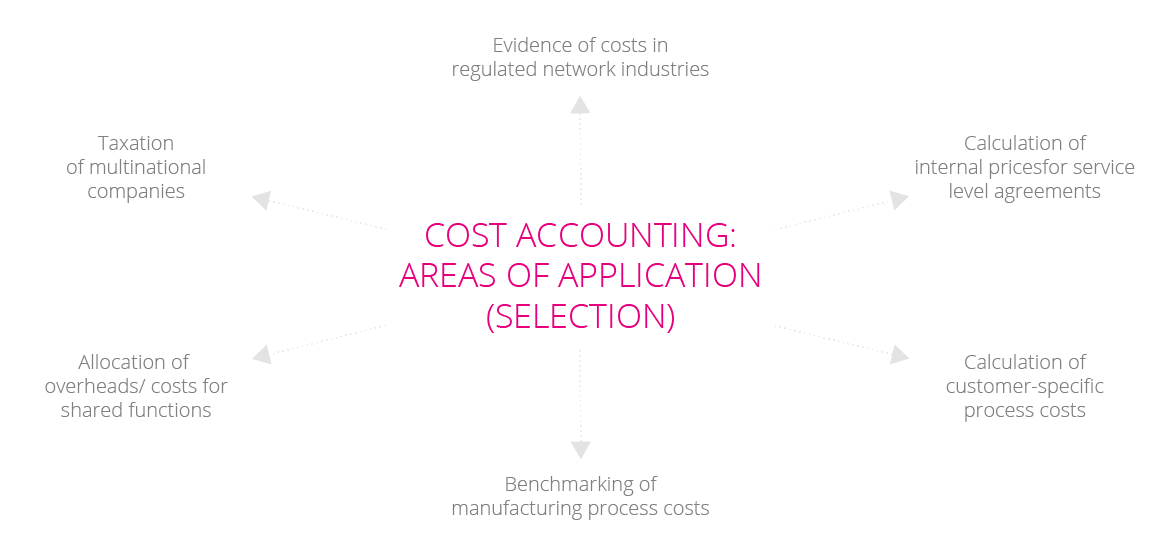

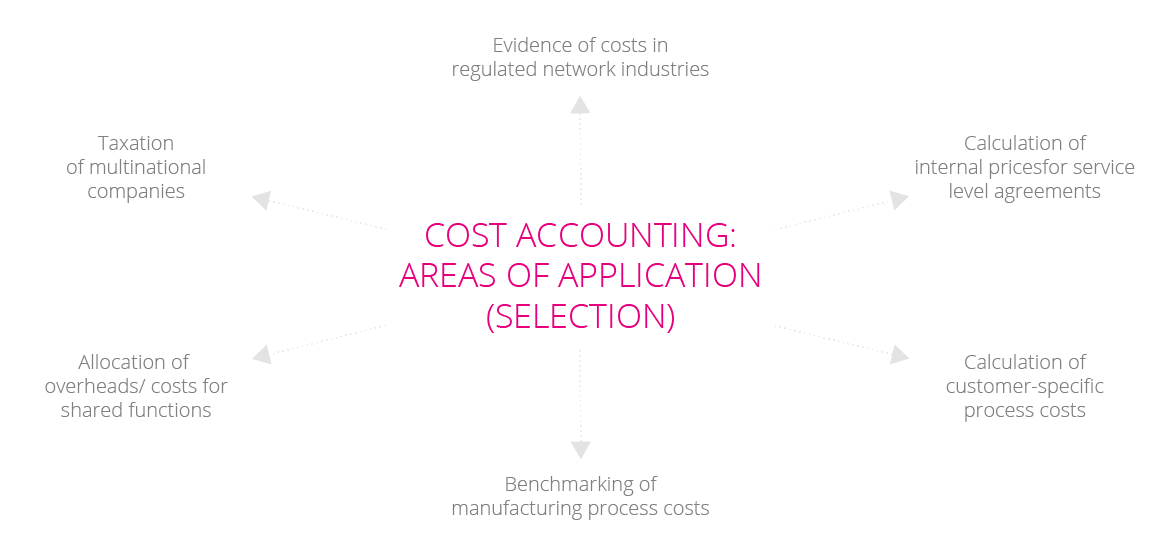

The heyday of managing companies on the basis of cost accounting is long past. Cost accounting reached the height of its popularity in the 1960s, when the idea was to set up cost planning per cost centre and to juxtapose actual costs against planned costs or target costs. Still: cost accounting (also known as cost and performance accounting or cost and earnings accounting) continues to be an important cost management tool which provides important pricing information. The widespread use of SAP software means that cost accounting is pre-integrated into financial and other company accounting. This standard software package also generally prescribes the use of a flexible budgeting approach.

Although many fundamental questions have been resolved, there are a number of levers and key issues:

CTcon will assist you in identifying customised solutions to these questions as well as in structuring your cost accounting to meet your specific needs. We have a long track record working with numerous large enterprises. An important success factor when structuring cost accounting is to ensure that it is compatible with the company’s management and steering approach. If required, CTcon will help manage IT implementation carried out by the client company itself or by an IT consultant.